Finance ,Insurance, loan ,Stock & Crypto

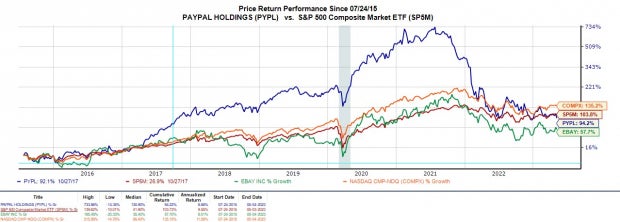

In the dynamic realm of financial technology, companies like PayPal and Block have long vied for leadership positions, yet find themselves currently trading near their 52-week lows. Worries about escalating competition and a measured rebound from inflationary pressures have impacted both companies, with PayPal's stock down -29% for the year and Block's shares falling -19%. However, a closer examination suggests that concerns about stalling growth might be premature.

Undervalued EPS Growth

As the specter of inflation began to recede earlier this year, the earnings outlook for the broader Zacks Computer & Technology sector witnessed a significant uptick. Although one might assume PayPal and Block are lagging behind, their EPS outlooks paint a different picture.

PayPal, while experiencing a more tempered growth compared to its past performance, anticipates an impressive 20% EPS growth in fiscal 2023, a figure outpacing the Zacks Computer & Technology sector's 10.72% growth rate. Moreover, PayPal's earnings are projected to rise an additional 13% in FY24, aligning with the sector's historical EPS growth rate.

Block, on the other hand, presents compelling figures, boasting a projected 69% EPS growth this year and a noteworthy 36% growth forecasted for the following year, both considerably surpassing the sector average.

More Reasonable Valuations

Concerns over high valuations, particularly in terms of price to earnings, have been a focal point for Block's stock, more so than PayPal. However, both companies' P/E valuations have moderated in relation to their historical highs.

Block's SQ shares presently trade at 27X forward earnings, a far cry from the extreme historical highs experienced during its profitability milestone, which saw a median of 259.6X. Additionally, Block's price to sales ratio of 1.3X is attractive, providing a useful metric for assessing the company's valuation while it continues to establish a profitable track record.

Remarkably, Block's P/S ratio has become notably reasonable, comfortably below the optimal threshold of less than 2X, and notably discounted compared to the S&P 500’s 3.9X.

For PayPal, its forward earnings multiple of 11.8X marks an 86% reduction from the five-year high of 87.8X for PYPL and a 74% discount relative to the median of 45.7X. In terms of price to sales, PayPal's P/S of 2.2X is inching towards the optimum level and is attractively below the benchmark.

Bottom Line

Despite facing headwinds in the market, PayPal and Block present a compelling case for being undervalued, supported by their above-average EPS growth. At present, both fintech players are bestowed with a Zacks Rank #3 (Hold), reflecting a favorable risk-to-reward proposition, even in the face of their recent declines.

For more investment insights and recommendations, visit Zacks Investment Research.

Download the 7 Best Stocks for the Next 30 Days today!

Writer Us- Sumit kumar