These 5 Best Stocks to Buy and Watch Right Now

These 5 Best Stocks to Buy and Watch Right NowStocks, ShareMarket, Cryptocurrency,

These 5 Best Stocks to Buy and Watch Right NowStocks, ShareMarket, Cryptocurrency,

Purchasing a stock is simple, however purchasing the right stock without a tried and true methodology is unbelievably hard. So what are the best stocks to purchase now or put on a watchlist?

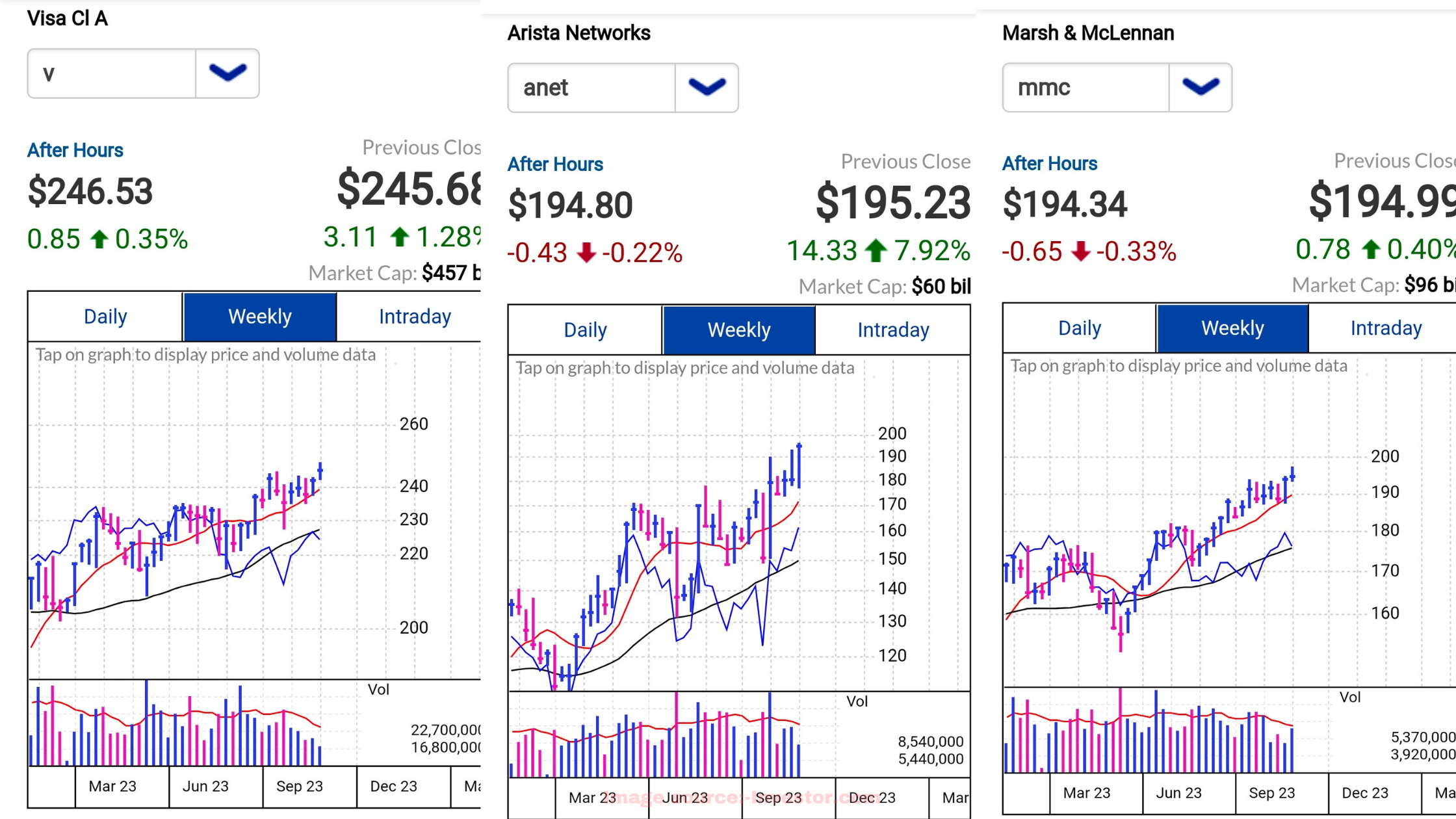

1:- Google parent Letter set (GOOGL)

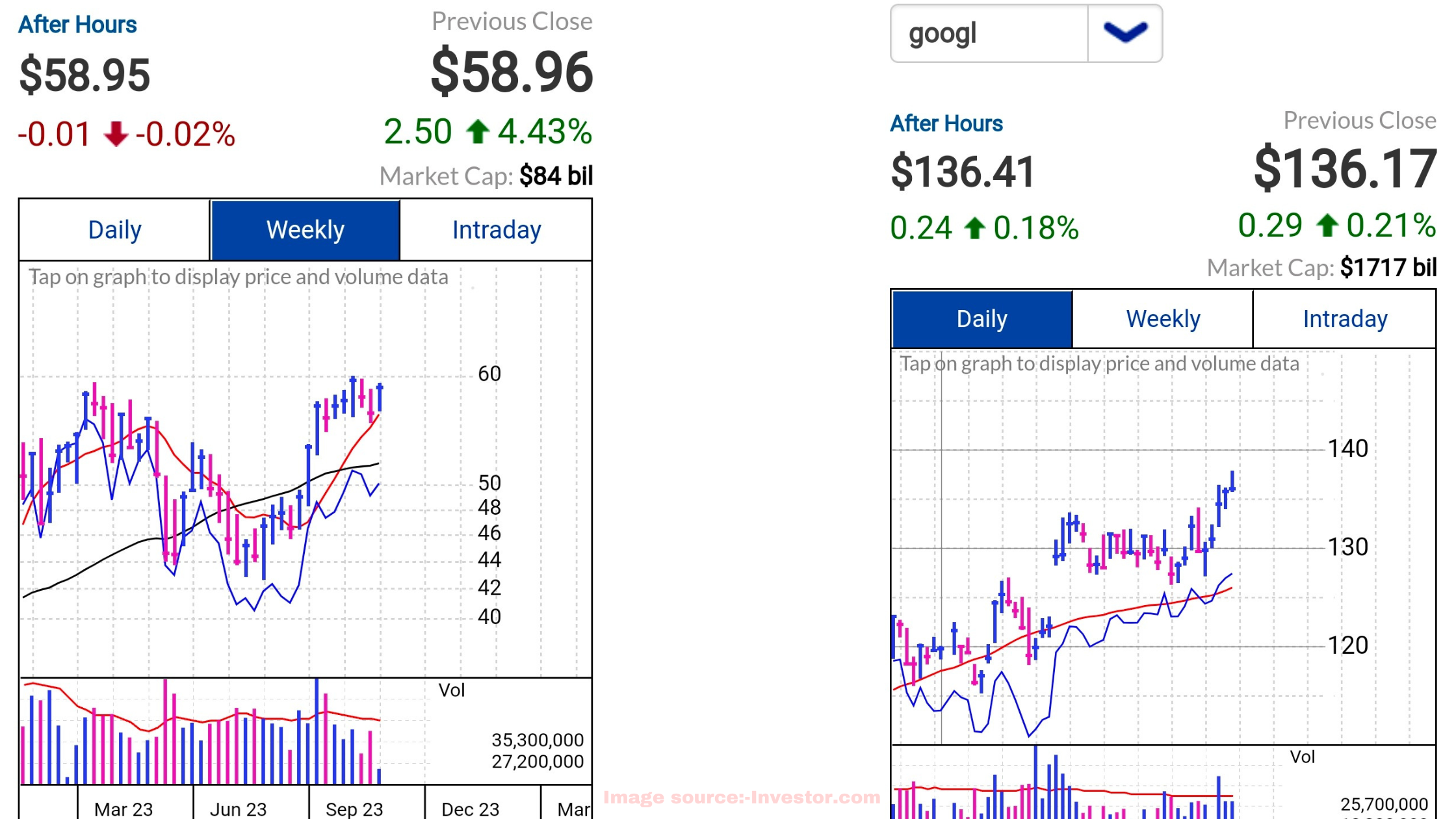

2:- SLB (SLB)

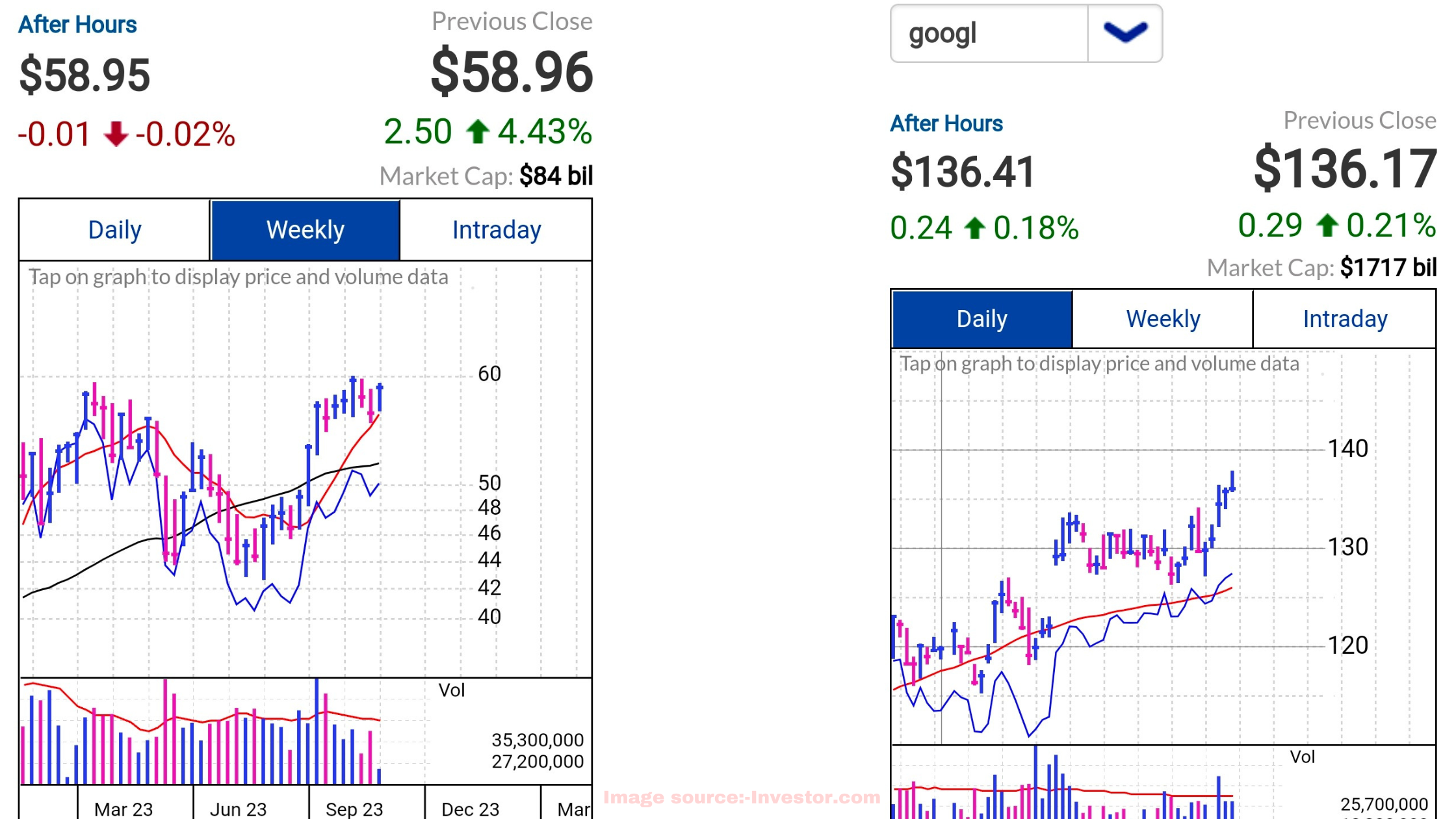

3:- Visa (V)

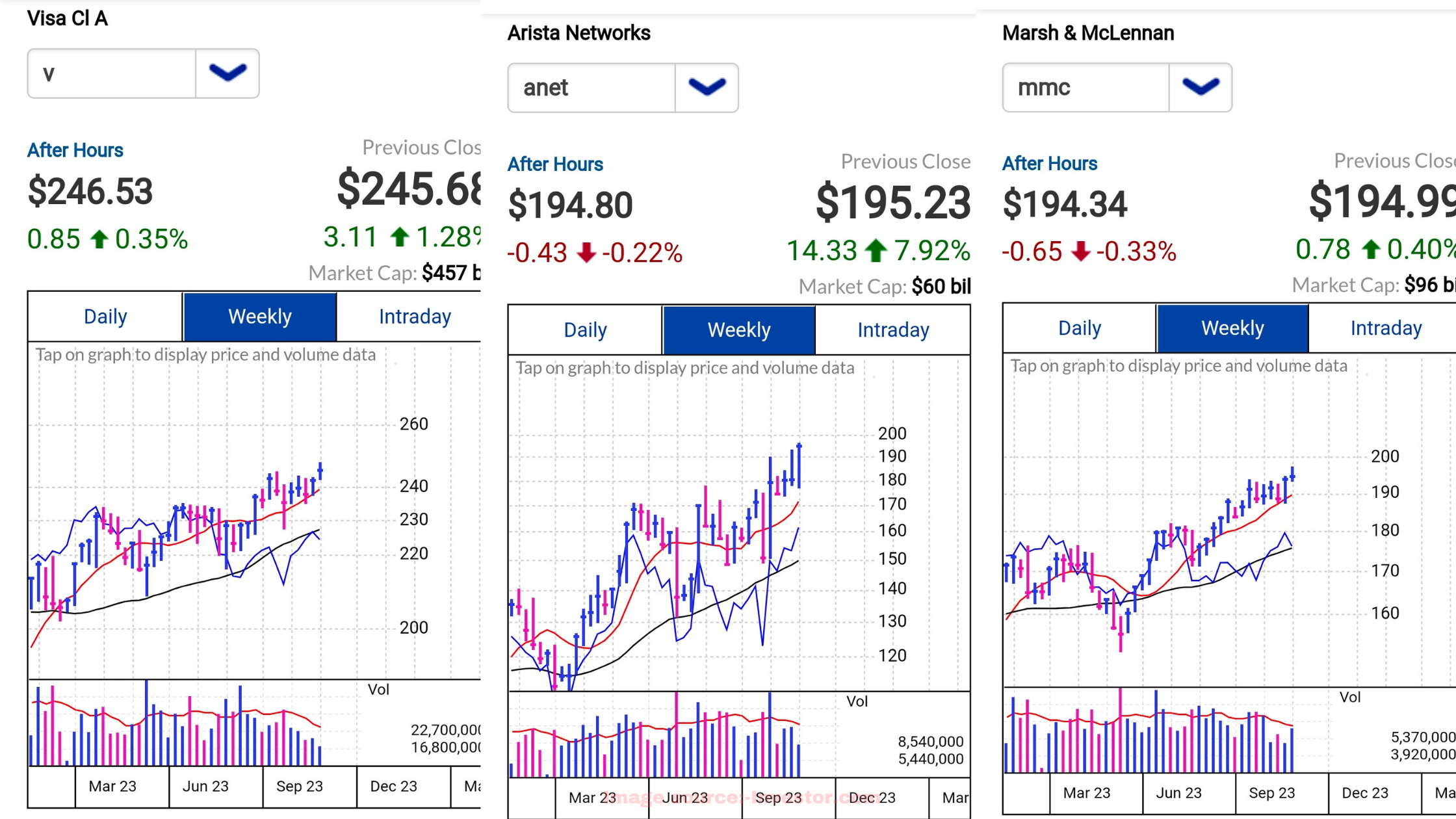

4:- Arista Organizations (ANET)

5:- Bog and McLennan (MMC)

Regardless of expansion stresses and the Central bank fixing rates forcefully, the market has frustrated assumptions for hardships in 2023 and has turned in major areas of strength for a such a long ways in 2023. The Russian intrusion of Ukraine keeps on creating a shaded area over business sectors.

Best Stocks To Purchase: The Vital Fixings

Keep in mind, there are great many stocks exchanging on the NYSE and Nasdaq. In any case, you need to find the absolute best stocks right now to produce huge additions.

The CAN Thin framework offers clear rules on the thing you ought to search for. Put resources into stocks with ongoing quarterly and yearly income development of something like 25%. Search for organizations that have new, game-changing items and administrations. Likewise consider not-yet-productive organizations, frequently late Initial public offerings, that are creating colossal income development.

IBD's CAN Thin Money management Framework has a demonstrated history of fundamentally beating the S&P 500. Outperforming this industry benchmark is vital to producing uncommon returns over the long haul.

Moreover, watch out for organic market for the actual stock, center around driving stocks in top industry gatherings, and go for the gold solid institutional help.

Whenever you have found a stock that fits the rules, it is then opportunity to go to stock graphs to plot a decent section point. You ought to trust that a stock will frame a base, and afterward purchase once it arrives at a purchase point, in a perfect world in weighty volume. Much of the time, a stock arrives at a legitimate purchase moment that it breaks over the first high on the left half of the base. More data on what a base is, and the way in which diagrams can be utilized to win enthusiastic about the financial exchange, can be seen as here.

Remember The M While Purchasing Stocks

A vital piece of the CAN Thin equation is the M, which represents market. Most stocks, even the absolute best, follow the market bearing. Put when the financial exchange is in an affirmed upturn and move to cash when the securities exchange goes into a revision.

While a financial exchange rally that started off 2022 before long fell all over, it has turned in staggering additions up until this point this year. In any case, files have pulled back of late, sending the Nasdaq and the S&P 500 back beneath the key 50-day moving normal.

The securities exchange is presently in a revision. Financial backers ought to quit purchasing shares by and large for the time being. Rather hope to fabricate a strong watchlist of extraordinary stocks, like those in the IBD 50. The stocks beneath are close to purchase focuses and are potential competitors.

The ongoing economic situations make it critical to keep steady over sell signals. Any stock that falls 7% or 8% from your price tag ought to be discarded. Additionally be careful with sharp breaks underneath the 50-day or 10-week moving midpoints. It is a great opportunity to be raising money - begin by selling your most fragile performing stocks first.

Keep in mind, there is as yet critical title risk. Expansion stays a central point of interest while the Russia-Ukraine struggle is a trump card that has demonstrated its capacity to shake the market.

Things can rapidly change with regards to the securities exchange. Ensure you watch out for the market pattern page here.

Best Stocks To Purchase Or Watch

A. Google

B. SLB

C. Visa

D. Arista Organizations

E. Swamp and McLennan

Presently how about we see Google stock, SLB stock, Visa stock, Arista Organizations stock and Bog and McLennan stock in more detail. A significant thought is that these stocks all brag noteworthy relative strength.

Google Stock:-

Google-parent Letter set is close to the highest point of a purchase zone subsequent to passing a 127.10 cup with handle purchase point.

The general strength line for GOOGL stock is rising once more, holding up better compared to most tech monsters, however off late highs. This measures a stock's presentation contrasted with the S&P 500.

GOOGL stock has a close ideal IBD Composite Rating of 98. That places it in the top 2% of stocks followed in general. Profit are insignificantly better compared to financial exchange execution, with its EPS Rating major areas of strength for an out of 99.

Experts see solid development ahead, with Google profit per share expected to flood by 20% in 2023 and in 2024

The tech monster has a General Strength Rating of 90. That implies it has beated 90% of stocks followed throughout the course of recent months regarding cost execution. Late execution is solid, with Google stock rising almost 51% such a long ways in 2023. This far surpasses the S&P 500's benefit of more than 17%.

Huge cash has been gobbling up Letter set load of late. This is reflected in its Collection/Circulation Rating of B-. This reflects more purchasing than selling throughout the course of recent weeks.

Google stock was supported after the firm posted second-quarter profit and income that beat investigator gauges. YouTube publicizing income beat assumptions, while the organization likewise approved extra GOOGL stock buybacks.

Google profit popped 19% to $1.44 per share. This finished a four-quarter line of year-over-year declines. Income rose 7% to $74.6 billion.

"Search income was superior to dreaded and sped up versus Q1," Goldman Sachs expert Eric Sheridan said in a note to clients. "End request patterns stayed stable as far as sponsor spending plan and item emphasis."

Investigators anticipate that simulated intelligence speculations should spike promoting and cloud income development. Capital spending in the subsequent quarter rose to $6.9 billion, up from $6.3 billion in the principal quarter.

"We accept Q2 exhibited Google's computer based intelligence ability in promotions and Cloud," Jefferies examiner Brent Thill said in a note. "We see the last part of 2023 proceeding to advance from a Q4 (2022) base."

Google means to counter Microsoft's (MSFT) interest in computerized reasoning startup OpenAI by making its own generative man-made intelligence apparatuses accessible to programming designers.

At the Google I/O 2023 designers occasion on May 10, Letter set exhibited how generative computer based intelligence will be coordinated into search, maps, Work area, photographs, distributed computing and Android gadgets. Google talked about how promoting will advance as generative computer based intelligence is added to look.

SLB Stock:-

SLB, previously Schlumberger, is exchanging just under a cup-with-handle base purchase point of 58.70 subsequent to exchanging above it for a few meetings. Financial backers could decide to utilize 60.12 as another handle. That would offer an early passage close to the earlier 58.70 section.

The stock has been trying help at the 21-day outstanding moving normal and presently sits just beneath the benchmark.

The 50-day moving normal likewise as of late cleared the 200-day line, a bullish specialized move known as the "brilliant cross."

Generally execution is first class, netting it a close ideal IBD Composite Rating of 98. Income execution is especially noteworthy, with EPS growing a normal 68% over the beyond 3/4.

The stock is additionally in the top 7% of issues concerning cost execution throughout recent months

SLB is one of the world's biggest suppliers of on-and seaward boring administrations. It additionally gives innovation to well boring, creation, and oil and gas handling.

Energy has been energizing of late, which has powered vertical energy for oil stocks. Oil field administrations monster SLB is significant subsequent to spiking, as U.S. oil costs hit new levels for 2023.

On July 21, SLB barely bested Q2 benefit assumptions yet missed on income. Notwithstanding this SLB CEO Olivier Le Peuch told experts he stays hopeful about the drawn out standpoint.

"We keep on seeing positive upstream venture force in the worldwide and seaward business sectors," he said. "These business sectors are being driven by strong long-cycle seaward turns of events, creation limit extensions, the arrival of worldwide investigation and evaluation, and the acknowledgment of gas as a basic fuel hotspot for energy security and the energy progress."

Experts see second from last quarter profit becoming 22% to 77 pennies for every offer with deals expanding 12% to $8.34 billion.

Moreover, Money Road is expecting SLB benefit to become 37% to $2.98 per share in 2023 while it is seen hopping a further 23% in 2024.

Visa Stock:-

The installment processor stock is noteworthy in the wake of clearing a level base authority purchase point of 235.57. It is has likewise recently produced another level base on which offers another, higher, official purchase point of 245.37.

The general strength line is moving higher again as of late yet has work to do to recover ongoing highs.

All-around presentation here is solid, with its IBD Composite Rating coming in at 93 out of 99.

Profit development is tough, in the event that not great, with EPS ascending by a normal of 15.4% over the beyond 3/4.

Gains are seen moving consistently higher. EPS is supposed to climb 16% in 2023 preceding rising an extra 14% in 2024

Institutional financial backers have been net purchasers of the supply of late, with its Collection/Circulation Rating coming in at B. Altogether, 51% of its stock is as of now held by assets with a further 2% being held by banks.

In the latest quarter Visa profit rose 9% to $2.16 per share on 12% income development to $8.1 billion, besting examiner sees. A strong U.S. buyer and solid travel patterns overall are powering exchange development.

Installments volume expanded 9% for the quarter while cross-line volume vaulted 17%.

Administration charge incomes rose 15% to $3.66 billion, beating assumptions for $3.63 billion. Information handling charges likewise rose 15% to $4.1 billion, beating FactSet evaluations of a 10.8% increase. Global exchange income swung 14% higher to $2.92 billion, however missed the mark regarding gauges of $3.01 billion.

The charge card monster hopes to have arisen solid from the new financial emergency started by the disappointment of Silicon Valley Bank. The occasion sent shock waves through monetary business sectors, with fair size banks enduring the worst part of misfortunes during the Walk disorder.

The central issue here for financial backers is that installment processors Visa and Mastercard don't convey card adjusts on their books. This is as opposed to American Express and Find Monetary (DFS).

Rather it is the responsible banks like JPMorgan Pursue (JPM) and Wells Fargo (WFC) that convey the potential gain and disadvantage on the arrangement of credit. Visa and Mastercard bring in cash using a loan and charge card exchange expenses.

For the present, at any rate, the U.S. economy keeps on resisting miserable assumptions. The Buyer Certainty File is at its most significant level since July 2021, as indicated by the most recent delivery from the Meeting Board

In a May 31 appearance at a Bernstein financial backer gathering, active Visa CFO Vasant Prabhu featured large open doors ahead, because of three development motors. While conventional customer installments keep on seeing strong development, "new streams and worth added administrations can become quicker" than installments from now into the indefinite future.

The new streams involve new-use cases for Visa's organization, including distributed installments, finance and cross-line settlements.

Arista Organizations Stock:-

Arista stock is exchanging a purchase zone over a 178.36 passage point. It originally moved over the level on Aug. 1 following its Q2 report.

It is as of now exchanging above the two its 21-day remarkable moving normal and its major moving midpoints. It has been bullishly finding support at the 21-day line.

That is in spite of experiencing a major drawback inversion with the more extensive market on Aug. 24.

ANET stock has a close ideal IBD Composite Rating of 98. Both income and financial exchange execution are incredible.

It is in the top 6% of stocks with regards to cost execution throughout recent months. Huge Cash have been net purchasers, with its Amassing/Conveyance Rating coming in at B-.

Arista's second-quarter income climbed 46% to $1.58 per share, besting appraisals of $1.44 per share. Additionally, income hopped 39% to $1.46 billion versus figures for $1.38 billion. ANET holds a strong EPS Rating of 98.

For the September quarter, Arista anticipated income in a scope of $1.45 billion to $1.5 billion. That beat evaluations of $1.39 billion.

Arista sells PC network changes that speed around interchanges among racks of PC servers stuffed into "hyperscale" server farms. These web server farms are intended to tighten up figuring drive when request floods.

In 2022, Facebook-parent Meta Stages (META) represented 26% of Arista's income. It caught 16% of its deals from Microsoft (MSFT).

ANET stock has been mobilizing as of late in the midst of the ongoing elation encompassing computer based intelligence. Arista stock has been on sees that assuming tech organizations are purchasing more artificial intelligence chips, they'll likewise put resources into PC organizing transmission capacity.

At a JPMorgan tech gathering on May 23, Arista's CFO Ita Brennan discussed a potential computer based intelligence help.

Brennan added: "We have conveyed some artificial intelligence use cases, yet all the same it's moderately little. I think we view at it as, it's a decent supporting of sort of future force and request, especially from a portion of the bigger hyperscale clients."

Following the June-quarter profit call, ANET stock examiner Michael Ng from Goldman Sachs said in a note to clients: "ANET gave a generally straightforward guide in its job as a provider in generative computer based intelligence organizing foundation with 2023 an arranging year with preliminaries, prompting pilots in 2024, and afterward huge group organizations in 2025."

William Blair examiner Sebastien Naji gave further knowledge into the conceivable outcomes in an exploration note.

"As to, Arista keeps on driving item upgrades to situate Ethernet as a solid cutthroat contribution for systems administration inside GPU groups," he said. "Arista is seeing preliminaries inside its cloud titan clients and anticipates that more critical artificial intelligence pilot organizations should begin in 2024."

Bog and McLennan Stock:-

MMC stock is simply over a level base purchase point of 194.16. The RS line is additionally building up speed.

The stock has been finding support at the 21-day dramatic moving normal, as well as its 50-day line. These are bullish markers.

In general solid execution has gotten the protection play a close ideal IBD Composite Rating of 97.

Huge Cash has been eating up the supply of late, with its Gathering/Dissemination Rating coming in at major areas of strength for a.

The New York City-based firm works in 130 nations across the globe, offering risk the board, protection and counseling administrations.

Bog and McLennan finished 20 acquisitions last year as it pursues development. In 2022, MMC's gamble and protection administrations business section created around 61% of the organization's $20.72 billion all out income in 2022.

On July 20, the organization posted surprisingly good second-quarter profit and income. Profit have advanced for the beyond two quarters.

The protection agent has arrived at the midpoint of around normal EPS development of 12% over the beyond 3/4.

Experts expect further development going ahead. Money Road anticipate profit becoming 18% to $1.39 per share in Q3 with income expanding 9% to $5.21 billion. For the entire year, Money Road gauges 13% EPS development and a business increment of 6%.

Such a long ways in 2023, Bog and McLennan has declared a large number of new acquisitions, including Israel-based reinsurance specialist Re Arrangements and the Philadelphia-based risk the executives firm Graham Organization.

The more extensive IBD-followed Protection Intermediaries industry bunch, including MMC stock, has barely beated the S&P 500 this year

Author:-Dr Vivek Garg

Table of Contents Introduction to Free Online Tools for PDF,...

Table of Contents How I Discovered Toolkhoj.com What Makes It...

महाशिवरात्रि के उपाय , बेर, काली मिर्च और धतूरे का...