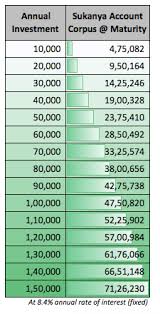

Have you heard of the Sukanya Samriddhi Yojana? Since it is obvious from the name that this programme is for ladies, let's learn more about it and find out how much money, 64 lakh rupees, you may deposit in it. You are eligible for up to Rs.

Sukanya Samriddhi Yojana is a government programme that allows you to open an account at any time from the birth of a girl child until she is 10 years old. She can deposit money into this account every month, and this quarter, from July to September, there is an interest rate of 8%. The money that is deposited into it is fully tax-free, as is the interest that is made on it.

what amount was deposited

What is the maximum deposit amount and when can I withdraw it?

You can deposit a minimum of Rs 250 and a maximum of Rs 1.5 lakh per month in the Sukanya Samriddhi Yojana. When the daughter gets 18, she can withdraw half of the money; when she is 21, she can withdraw the entire amount.

When will I receive Rs 64 lakh?

If Rs. 12,500 is paid into the SSY programme each month, it will grow to Rs. 1.5 lakh in a year, and there won't be any taxes due on it. Even if we assume a 7.6% interest rate at maturity, your daughter will get this money till she reaches adulthood. When your daughter turns 21, a sizable fund will be formed under this arrangement, and if you remove the entire sum,

So, Rs 63 lakh 79 thousand 634 will be the maturity amount. This investment will be for Rs 22,50,000. The interest, however, will be Rs 41,29,634. By doing so, you can amass a wealth of Rs 64 lakh if you deposit Rs 12,500 into a Sukanya Samriddhi account each month

What is the advantage of this plan?

This sum will allow your daughter to pursue higher education because it is now highly expensive and because marriage is prioritised over all else in India. She will then be able to move forward with her bright future. ability to use that money as well

An investor who contributes one lakh rupees annually to the Sukanya Samriddhi Yojana will have invested fifteen lakh rupees after 15 years. In this instance, the complete sum is redeemable after 21 years for up to Rs 44,89,690. The investor would receive Rs 29,89,690 in this sum as interest on the government's total investment.