Finance ,Insurance, loan ,Stock & Crypto

POWR OF SWP - SYSTEMATIC WITHDRAWAL PLAN - BETTER THAN FIXED DEPOSIT

POWR OF SWP - SYSTEMATIC WITHDRAWAL PLAN - BETTER THAN FIXED DEPOSIT

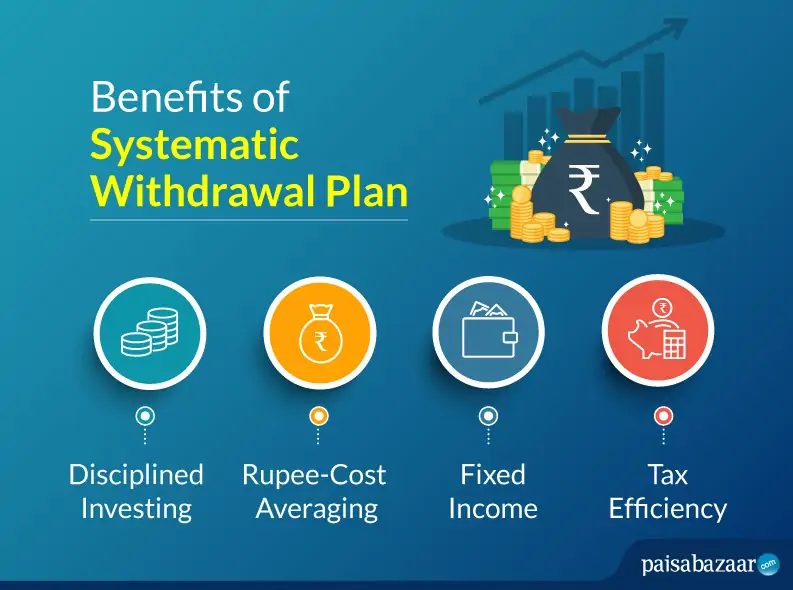

Systematic Withdrawal Plan (SWP): Most of them know SIP Systematic Investment Plan in which a certain amount is invested on a particular date every month by those who are working and wants to take some good returns on their small amount every month they invest.

There are people who have already retired or need a regular income to prefer SWP. A systematic Withdrawal Plan is similar to a Fixed Deposit. If you deposit a certain amount and go on withdrawing some money as per your requirement on one side and at the same time in SWP there is a chance to increase your principal amount even if you regularly withdraw some money.

POWR OF SWP - SYSTEMATIC WITHDRAWAL PLAN - BETTER THAN FIXED DEPOSIT

Systematic Withdrawal Plan (SWP): Most of them know SIP Systematic Investment Plan in which a certain amount is invested on a particular date every month by those who are working and wants to take some good returns on their small amount every month they invest.

There are people who have already retired or need a regular income to prefer SWP. A systematic Withdrawal Plan is similar to a Fixed Deposit. If you deposit a certain amount and go on withdrawing some money as per your requirement on one side and at the same time in SWP there is a chance to increase your principal amount even if you regularly withdraw some money.

Let us analyze a practical case study in which a person invested Rs. 25 lakhs on 20.08.2014 and he needs every month Rs. 20000/- from 10.9.2014( Every month on the 10th he will automatically receive this Rs.20000/- in his bank account).

At the end of 108 months (nine years), the total withdrawal is Rs.21,60,000/- and the fund value as of 12.8.2023 is Rs.37,53, 829/-. Details are given below for information.

Click the link below for full information.

The illustration is to show what is SWP and how it is better than Fixed Deposit. Before investing consult your Mutual Fund Adviser.

https://www.advisorkhoj.com/mutual-funds-research/mutual-fund-swp-investment-calculator?amc=Mirae%20Asset%20Mutual%20Fund&scheme_name=Mirae%20Asset%20Large%20Cap%20Gr&intial_amount=2500000&swp_date=10&withdrawal_amount=20000&period=Monthly&from_date=10-09-2014&to_date=12-08-2023&init_start_date=20-08-2014

Disclaimer: Mutual Fund investments are subject to market risks, read all scheme-related documents carefully.. The NAVs of the schemes may go up or down depending on market conditions and other situations. Before investment read and analyse all the parameters.

Tag: SWP, SIP, Regular Income, Fixed Deposit, Mutual Fund