Finance ,Insurance, loan ,Stock & Crypto

Mutual funds

Mutual funds have become a popular investment option for both novice and seasoned investors. They offer a diversified portfolio of securities managed by professional fund managers, making them an attractive choice for those seeking a convenient and potentially profitable investment avenue. In this article, we will delve into the world of mutual funds, exploring what they are, how they work, their types, benefits, and considerations before investing.

Mutual funds , stock market

Mutual Funds

Understanding Mutual Funds: A Comprehensive Guide

Mutual funds have become a popular investment option for both novice and seasoned investors. They offer a diversified portfolio of securities managed by professional fund managers, making them an attractive choice for those seeking a convenient and potentially profitable investment avenue. In this article, we will delve into the world of mutual funds, exploring what they are, how they work, their types, benefits, and considerations before investing.

What is a Mutual Fund?

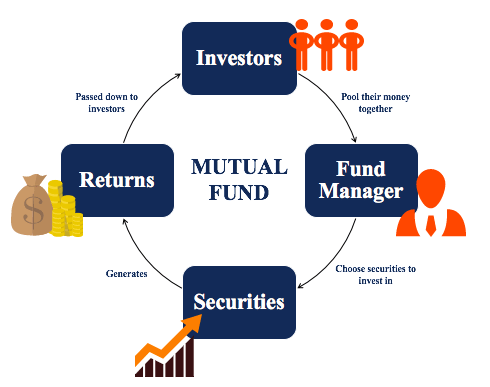

A mutual fund is a collective investment vehicle that pools money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. These funds are managed by professional portfolio managers or investment advisors who make decisions regarding buying, selling, and managing the portfolio to achieve the fund's investment objectives.

How Do Mutual Funds Work?

When an individual invests in a mutual fund, they purchase shares, which represent a portion of the holdings of the fund. The value of these shares is determined by the fund's net asset value (NAV), calculated daily based on the fund's total assets minus its liabilities.

Investors can buy or sell mutual fund shares at the fund's NAV price, usually at the end of the trading day. The fund's NAV is the per-share market value of all its securities. When an investor buys shares, the fund issues new shares, and when they sell, the fund buys back the shares at their NAV.

Types of Mutual Funds

Mutual funds can be broadly categorized into several types based on their investment objectives, asset classes, and management styles. Some common types include:

- Equity Funds: These funds primarily invest in stocks or equities. They offer the potential for high returns but come with a higher level of risk due to market volatility.

- Fixed-Income or Bond Funds: These funds primarily invest in government or corporate bonds. They are considered less risky compared to equity funds and provide regular income through interest payments.

- Money Market Funds: These funds invest in short-term, low-risk instruments like Treasury bills and commercial paper. They are known for stability and liquidity.

- Hybrid or Balanced Funds: These funds invest in a mix of both stocks and bonds, aiming for a balanced portfolio that offers growth and income.

- Index Funds: These funds aim to replicate the performance of a specific market index, such as the S&P 500. They typically have lower fees and are considered a passive investment option.

- Sector-Specific Funds: These funds focus on a specific sector of the economy, such as technology, healthcare, or energy.

- Real Estate Investment Trusts (REITs): While not traditional mutual funds, REITs pool funds to invest in real estate properties and distribute the income generated from them to investors.

Benefits of Mutual Funds

Investing in mutual funds offers several advantages to investors:

- Diversification: Mutual funds invest in a wide range of securities, providing investors with a diversified portfolio, which helps reduce overall risk.

- Professional Management: Expert fund managers handle investment decisions, leveraging their expertise and experience to manage the portfolio effectively.

- Liquidity: Mutual fund shares can be bought or sold on any business day, providing investors with liquidity and flexibility.

- Affordability: With mutual funds, even small investors can access a diversified portfolio that would otherwise require a significant capital outlay.

- Access to Various Asset Classes: Mutual funds allow investors to access various asset classes like stocks, bonds, and money market instruments through a single investment.

- Convenience: The administrative work, recordkeeping, and reporting are handled by the fund, making investing in mutual funds convenient for investors.

Considerations Before Investing

While mutual funds offer numerous benefits, it's essential for investors to consider a few factors before investing:

- Investment Objective and Risk Tolerance: Assess your financial goals and risk tolerance to choose a mutual fund that aligns with your objectives. For instance, if you seek higher returns and are willing to accept higher risk, you may opt for equity funds.

- Expense Ratios and Fees: Understand the fund's expense ratio, which represents the annual fees as a percentage of the fund's assets. Lower expense ratios are generally preferred as they minimize the impact of fees on your returns.

- Past Performance: While past performance is not indicative of future results, reviewing a fund's historical performance can provide insights into its track record and management's capabilities.

- Exit Load and Redemption Policies: Be aware of any exit loads or redemption fees associated with selling your mutual fund shares. These fees may vary based on the fund and holding duration.

- Tax Implications: Understand the tax implications of investing in mutual funds, including capital gains taxes and dividends, to effectively plan your tax strategy.

Conclusion

Mutual funds offer a diversified, professionally managed investment option for a broad range of investors. Understanding the different types of mutual funds, their benefits, and considering various factors before investing can help you make informed decisions and build a well-balanced investment portfolio that aligns with your financial goals and risk tolerance. It's always advisable to consult with a financial advisor before making investment decisions to ensure they fit your unique financial situation and objectives.

Writter: Anil Chaudhary