Finance ,Insurance, loan ,Stock & Crypto

Make Rich or Risks To Speculation Formula On The Future with Derivatives in 2024

Derivatives, Futures, and Options Trends Formula in 2024

Overview

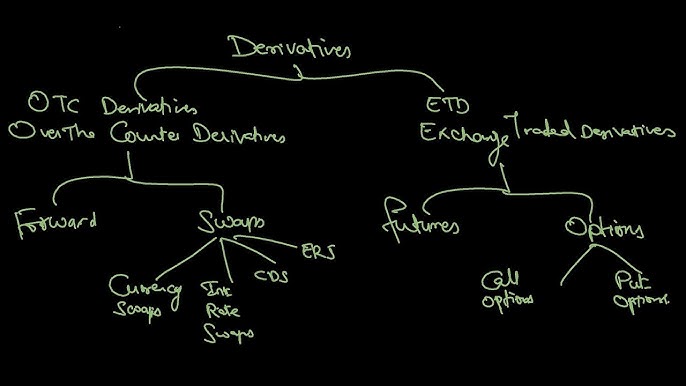

Derivatives, futures, and options are all financial contracts that derive their value from an underlying asset, such as a stock, bond, commodity, or currency. They can be used to hedge against risk, to speculate on market movements, or to gain exposure to different asset classes.

In recent years, derivatives, futures, and options have all seen increased trading activity and interest from investors. This is due to a number of factors, including:

- Increased volatility in the markets.

- The growing popularity of passive investing.

- The development of new technologies.

Increased Volatility in the Markets

One of the main factors driving the growth in derivatives, futures, and options trading is increased volatility in the markets. Volatility is a measure of how much the prices of assets fluctuate over time. In recent years, volatility has increased in all asset classes, including stocks, bonds, and commodities.

This increased volatility has led more investors to use derivatives to hedge against risk. Hedging is a strategy that investors use to reduce their exposure to risk. For example, an investor who owns a stock portfolio may buy put options on the S&P 500 index to hedge against a decline in the stock market.

The Growing Popularity of Passive Investing

Another factor driving the growth in derivatives, futures, and options trading is the growing popularity of passive investing. Passive investors are investors who invest in index funds and ETFs. Index funds and ETFs are baskets of securities that track a particular market index, such as the S&P 500 or the Dow Jones Industrial Average.

Passive investors often use derivatives to gain exposure to different asset classes or to diversify their portfolios. For example, a passive investor who invests in an S&P 500 index fund may use futures contracts to gain exposure to international stock markets.

Top stocks in derivatives, futures, and options in the Indian market:

- Reliance Industries (RELIANCE)

- Infosys (INFY)

- HDFC Bank (HDFCBANK)

- ICICI Bank (ICICIBANK)

- Tata Consultancy Services (TCS)

- Hindustan Unilever (HINDUNILVR)

- Kotak Mahindra Bank (KOTAKBANK)

- Bajaj Finance (BAJFINANCE)

- SBI Cards (SBICARD)

- HDFC Life Insurance (HDFCLIFE)

- ICICI Prudential Life Insurance (ICICIPRULI)

- ITC (ITC)

The Development of New Technologies

New technologies have also made derivatives, futures, and options trading easier and more efficient. For example, online trading platforms have made it easy for individual investors to trade derivatives.

In addition, new technologies have led to the development of new derivatives products, such as volatility derivatives and credit derivatives. These products allow investors to hedge against specific risks or to speculate on market movements.

Trends in Derivatives, Futures, and Options Trading

Some specific trends in derivatives, futures, and options trading:

- Increased trading volume in all asset classes. According to the Futures Industry Association (FIA), global derivatives trading volume reached a record high of 30.28 billion contracts in 2018. This trend is expected to continue in the coming years.

- Growing popularity of exchange-traded funds (ETFs) and exchange-traded notes (ETNs) that track derivatives indices. ETFs and ETNs provide investors with a convenient and low-cost way to invest in derivatives.

- Development of new derivatives products, such as volatility derivatives and credit derivatives. These products allow investors to hedge against specific risks or to speculate on market movements.

Benefits of Derivatives, Futures, and Options

Derivatives, futures, and options offer a number of benefits to investors, including:

- Risk management. Derivatives can be used to hedge against risk and to reduce the volatility of investment portfolios.

- Speculation. Derivatives can be used to speculate on market movements and to generate potential profits.

- Diversification. Derivatives can be used to gain exposure to different asset classes and to diversify investment portfolios.

Top stocks in derivatives, futures, and options

The top stocks in derivatives, futures, and options in the Indian market are those that are highly liquid and have a lot of open interest. This means that there are many buyers and sellers for these stocks, which makes it easy to trade them. Additionally, these stocks tend to be volatile, which makes them attractive to traders who are looking to make short-term profits.

These stocks are all highly liquid and have a lot of open interest, making them popular with derivatives, futures, and options traders. Additionally, they are all large-cap stocks with strong track records of growth.

It is important to note that trading derivatives, futures, and options is risky and should only be done by investors who understand the risks involved.

Tips for trading derivatives, futures, and options in the Indian market:

- Use a broker that is registered with the Securities and Exchange Board of India (SEBI).

- Start small and gradually increase your trading size as you gain experience.

- Do your research before trading any stock, including those that are popular with derivatives, futures, and options traders.

- Use stop-loss orders to limit your losses.

- Have a trading plan and stick to it.

End of Conclusion

The derivatives, futures, and options markets are growing and evolving, and investors are increasingly using these products to manage their risk and to achieve their investment goals.

Points to keep in mind when trading derivatives, futures, and options:

- Derivatives are complex financial products and should only be traded by investors who understand the risks involved.

- Derivatives can be used to hedge against risk, to speculate on market movements, or to gain exposure to different asset classes.

- The benefits of derivatives depend on the specific needs of the investor.

- Investors should carefully consider their investment objectives and risk tolerance before trading derivatives.

Disclaimer:Investors should carefully consider their investment objectives and risk tolerance before trading derivatives with your own research.

Writer

Devraj Gorai