Finance ,Insurance, loan ,Stock & Crypto

Indian Commodity Traders Making Millions: Could You Be Next?

Commodity trading on the rise in the Indian market

Introduction

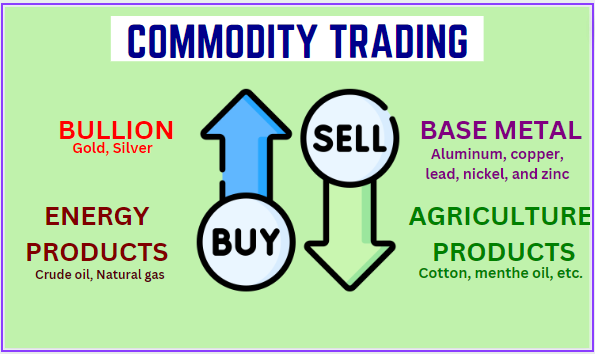

Commodity trading is the buying and selling of raw materials and agricultural products. It is a risky but potentially rewarding activity that can be used to hedge against price fluctuations, generate income, or speculate on future price movements.

The Indian commodity market has grown significantly in recent years, and it is now one of the largest commodity markets in the world. This growth is due to a number of factors, including:

-

Growing economy: India is one of the fastest growing economies in the world, and this is driving demand for commodities such as oil, metals, and agricultural products.

- Increasing urbanization: India is also urbanizing rapidly, and this is leading to increased demand for construction materials and other commodities.

- Deepening financial markets: India's financial markets are becoming increasingly sophisticated, and this is making it easier for investors to trade commodities.

- Government support: The Indian government is supportive of commodity trading, and it has taken a number of steps to promote the development of the market.

Benefits of commodity trading

Commodity trading offers a number of benefits, including:

- Hedging against price fluctuations: Commodity trading can be used to hedge against price fluctuations in the market. For example, a farmer can sell their crop futures contract to lock in a price for their crop before it is harvested. This can help to protect the farmer from falling prices.

- Generating income: Commodity trading can be used to generate income. For example, an investor can buy a commodity futures contract and sell it when the price has risen. The investor can then keep the difference as profit.

- Speculating on future price movements: Commodity trading can be used to speculate on future price movements. For example, an investor can buy a commodity futures contract if they believe that the price of the commodity is going to rise in the future. If the price does rise, the investor can sell the contract at a profit.

Types of commodity trading

There are two main types of commodity trading:

- Spot trading: Spot trading is the buying and selling of commodities for immediate delivery.

- Futures trading: Futures trading is the buying and selling of contracts that agree to deliver a certain quantity of a commodity at a specified price on a future date.

Commodity exchanges in India

There are two main commodity exchanges in India:

- Multi Commodity Exchange (MCX): MCX is the largest commodity exchange in India. It offers futures contracts on a wide range of commodities, including gold, silver, copper, oil, and agricultural products.

- National Commodity and Derivatives Exchange (NCDEX): NCDEX is the second largest commodity exchange in India. It specializes in agricultural commodity futures contracts.

How to trade commodities in India

To trade commodities in India, you need to open an account with a commodity broker. Commodity brokers are licensed by the Securities and Exchange Board of India (SEBI).

Once you have opened an account with a commodity broker, you can start trading commodities by placing orders through the broker's trading platform.

Tips for successful commodity trading

Some tips for successful commodity trading:

- Do your research: Before you start trading commodities, it is important to do your research and understand the market. This includes understanding the factors that affect commodity prices and the risks involved in commodity trading.

- Start small: When you are starting out, it is best to start with small trades. This will help you to learn the market and minimize your losses.

- Use stop-loss orders: Stop-loss orders can help to limit your losses if the price of a commodity moves against you.

- Don't overtrade: It is important to avoid overtrading. Overtrading can lead to losses and can also be stressful.

List of the best commodity stocks in India in 2023, in text format:

- Oil and Gas: Oil India Limited (OIL), ONGC Videsh Limited (OVL), Reliance Industries Limited (RIL)

- Metals: Hindustan Copper Limited (HCL), Jindal Steel & Power Limited (JSPL), Tata Steel Limited (TSL)

- Agriculture: Bayer CropScience Limited (BAY), Kaveri Seed Company Limited (KSCL), National Fertilizers Limited (NFL)

These companies are leaders in their respective industries and are well-positioned to benefit from rising commodity prices. They also have strong track records of profitability and dividend growth.

Commodity stocks in India, it is important to consider the following factors:

- Financial strength

- Dividends

- Management team

- Valuation

Commodity stocks can be a volatile investment, but they can also be very rewarding. By carefully selecting your investments and diversifying your portfolio, you can minimize your risk and maximize your potential returns.

End of Conclusion

Commodity trading is a risky but potentially rewarding activity that can be used to hedge against price fluctuations, generate income, or speculate on future price movements. The Indian commodity market is one of the largest commodity markets in the world, and it is expected to continue to grow in the future. If you are interested in trading commodities in India, it is important to do your research and understand the market before you start trading.

Additional tips for commodity traders in India

- Stay informed: It is important to stay informed about the latest news and developments in the commodity market. This will help you to make informed trading decisions.

- Use technical analysis: Technical analysis is a method of analyzing commodity price charts to identify patterns and trends. Technical analysis can be used to identify potential trading opportunities.

- Risk management: Risk management is essential for successful commodity trading. It is important to develop a risk management plan and to stick to it.

- Be patient: Commodity trading is a long-term game. It is important to be patient and to not expect to get rich quick

Disclaimer

The information I have provided in this article is for informational purposes only and should not be construed as financial advice. You should always consult with a qualified financial advisor before making any investment decisions.

Writer

Devraj Gorai