Finance ,Insurance, loan ,Stock & Crypto

Eager for higher bank FD rates? These corporate fixed deposits provide yields of up to 7.25% on three-year investments.

Corporate fixed deposits present a viable avenue for securing more substantial interest rates than those offered by banks. However, the caveat lies in the risk of default, particularly in the case of lower-rated FDs. Prior to investing, it is imperative to scrutinize credit ratings and the financial health of the issuing companies.

Disclaimer :- The vision of Tvcfeed.com is to promote financial literacy in India. The content we post is purely for education and entertainment purposes. We are not SEBI registered financial advisors. Therefore we do not provide any investment or financial advisory services. You will be completely responsible for your money and your decisions. Please consult a SEBI registered financial advisor for your financial investments.

Eager for higher bank FD rates? These corporate fixed deposits provide yields of up to 7.25% on three-year investments.

Corporate fixed deposits present a viable avenue for securing more substantial interest rates than those offered by banks. However, the caveat lies in the risk of default, particularly in the case of lower-rated FDs. Prior to investing, it is imperative to scrutinize credit ratings and the financial health of the issuing companies.

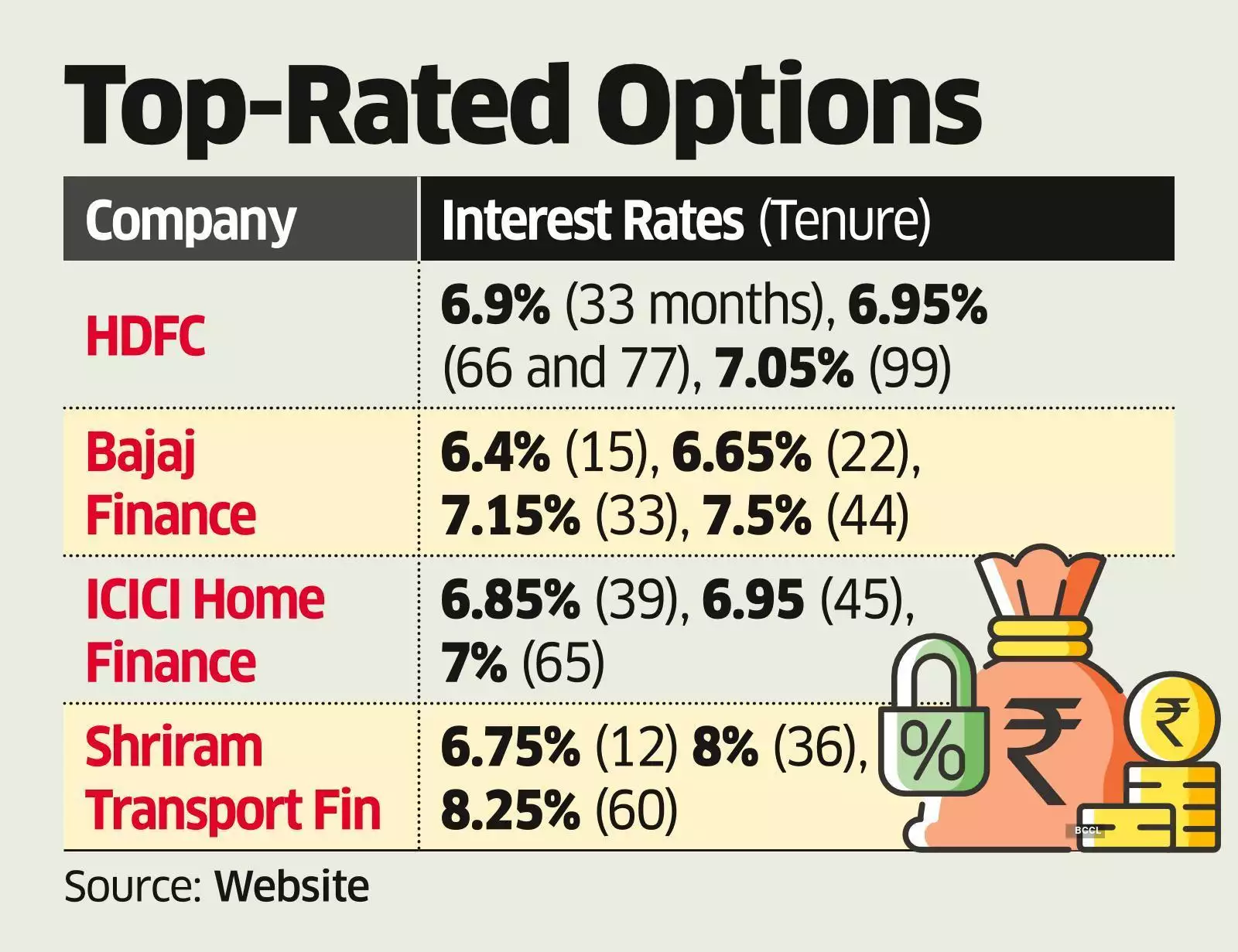

Non-banking financial companies (NBFCs) and Housing Finance Companies (HFCs) issue corporate fixed deposits, which offer superior interest rates compared to bank fixed deposits (FDs). Notably, the interest rates provided by public sector banks and major private sector banks pale in comparison. It's essential to note that unlike bank FDs, corporate FDs are not protected by DICGC deposit insurance, which extends up to Rs 5 lakh.

It's advisable to review the credit ratings assigned to FDs by reputed rating agencies like CRISIL, ICRA, CARE, and others. These ratings gauge the companies' capacity to fulfill interest payments and repay the principal upon FD maturity. Essentially, they assess the financial robustness of the companies. Corporate FDs with higher ratings are associated with lower probabilities of default concerning both interest and principal repayments. Here, we compile a list of corporate FDs offering competitive interest rates, as collated by Paisabazaar.

Shriram Transport Finance Co. Ltd. extends an interest rate of 7.25 percent per annum (compounded monthly) on cumulative FDs spanning a three-year tenure. Consequently, a cumulative FD of Rs 10,000 opened for a three-year tenure will accumulate to Rs 12,420 upon maturity. Additionally, the NBFC offers an incremental interest rate of 0.25 percent per annum for renewals of matured deposits. CRISIL has bestowed a credit rating of FAAA/Stable upon this NBFC. In CRISIL's evaluation, FAAA signifies a very high likelihood of timely interest and principal repayment by the NBFC. Furthermore, the credit rating agency ICRA has attributed the credit rating of MAA+/Stable to this NBFC. According to ICRA, an MAA rating reflects a high credit quality with minimal credit risk for depositors.

Shriram City Union Finance Co. Ltd offers an interest rate of 7.25 percent per annum (compounded monthly) on cumulative FDs lasting for a three-year term. Consequently, a cumulative FD of Rs 10,000 opened for a three-year tenure will accumulate to Rs 12,420 upon maturity. Deposit holders are also entitled to an additional interest of 0.25 percent per annum on renewals of matured deposits. The credit rating agency ICRA has assigned the credit rating of MAA+/Stable to this NBFC. According to ICRA, an MAA rating reflects a high credit quality with minimal credit risk for depositors.

Bajaj Finance Ltd offers an interest rate of 7.00 percent per annum on cumulative FDs with a three-year tenure. The minimum deposit amount specified by the NBFC is Rs 15,000. Therefore, a cumulative FD of Rs 15,000 opened for a three-year tenure will accumulate to Rs 18,376 upon maturity. CRISIL has conferred a credit rating of FAAA/Stable upon this NBFC. In CRISIL's assessment, FAAA denotes a very high likelihood of timely interest and principal repayment by the NBFC. Additionally, ICRA has assigned a credit rating of MAAA/Stable. According to ICRA, MAAA signifies the highest credit quality with minimal credit risk for depositors.

Muthoot Capital Services Ltd offers an interest rate of 6.75 percent per annum (compounded annually) on cumulative FDs with a three-year tenure. Consequently, a cumulative FD of Rs 10,000 opened for a three-year tenure will accumulate to Rs 12,165 upon maturity. The credit rating agency CRISIL has conferred the credit rating of FA+/Stable upon Muthoot Capital Services Ltd. CRISIL's FA rating indicates adequate safety concerning the timely payment of interest, and principal repayment is deemed satisfactory.

PNB Housing Finance Ltd offers an interest rate of 6.60 percent per annum (compounded annually) on cumulative FDs spanning a three-year term. Consequently, a cumulative FD of Rs 10,000 opened for a three-year tenure will accumulate to Rs 12,114 upon maturity. The credit rating agency CRISIL has attributed the credit rating of FAA+/Negative to this HFC. As per this rating agency, FAA indicates a strong likelihood of timely interest and principal repayment by the HFC. Credit rating agency CARE has conferred the credit rating of AA/Stable upon this HFC. According to CARE, AA rating denotes a high degree of safety concerning the timely servicing of financial obligations and carries very minimal credit risk for depositors.

ICICI Home Finance Ltd offers an interest rate of 6.20 percent per annum (compounded annually) on cumulative FDs with a three-year tenure. Consequently, a cumulative FD of Rs 10,000 opened for a three-year tenure will accumulate to Rs 11,978 upon maturity. CRISIL has assigned a credit rating of FAAA/Stable to this HFC. In CRISIL's assessment, FAAA signifies a very high likelihood of timely interest and principal repayment by the HFC. Furthermore, ICRA has attributed the credit rating of MAAA/Stable. According to ICRA, MAAA represents the highest credit quality rating and, therefore, indicates the lowest credit risk for depositors. Credit rating agency CARE has conferred the credit rating of AAA/Stable upon this HFC. As per the rating agency, AAA denotes the highest degree of safety concerning the timely servicing of financial obligations and carries the lowest credit risk.

HDFC Ltd offers an interest rate of 6.30 percent per annum (compounded annually) on cumulative FDs with a three-year tenure. Consequently, a cumulative FD of Rs 10,000 opened for a three-year tenure will accumulate to Rs 12,012 upon maturity. This HFC extends an additional interest rate of 0.05 percent per annum on individual deposits renewed or placed through their online deposit system and auto-renewed deposits. CRISIL has bestowed a credit rating of FAAA/Stable upon this HFC. According to CRISIL, FAAA signifies a very high likelihood of timely interest and principal repayment by the HFC. Furthermore, ICRA has assigned the credit rating of MAAA/Stable. As per ICRA, MAAA denotes the highest credit quality rating and carries the lowest credit risk for depositors.

NOTE: This is for information only while investing kindly go through the complete details of the concerned company and its performance.