Buy these 2 shares now, they are available for Rs 150, you will get a return of crores for Rs 1000.

Buy these 2 shares now, they are available for Rs 150, you will get a return of crores for Rs 1000.

Stockmarket , Stocks

Buy these 2 shares now, they are available for Rs 150, you will get a return of crores for Rs 1000.

Stockmarket , Stocks

Buy these 2 shares now, they are available for Rs 150, you will get a return of crores for Rs 1000.

Hello friends, welcome to all of you in our another new and fresh article, today through this article we are going to know about two such shares, currently the price of life is only around ₹ 150 and in the coming time this share will increase. You may get to see even up to ₹ 1000. According to the information given by the experts, this stock can do great wonders in the coming time, so you will also be very curious.

To know the name of these 2 shares but before that I would like to make a request to all of you, if you have come for the first time on our website and want to get updates related to share market, then you can join our WhatsApp community Telegram community there We keep providing updated information from the stock market continuously.

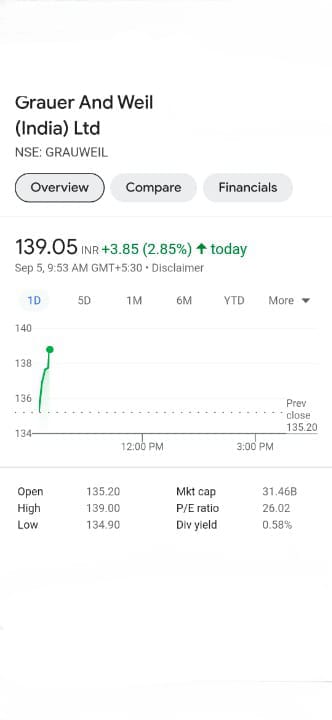

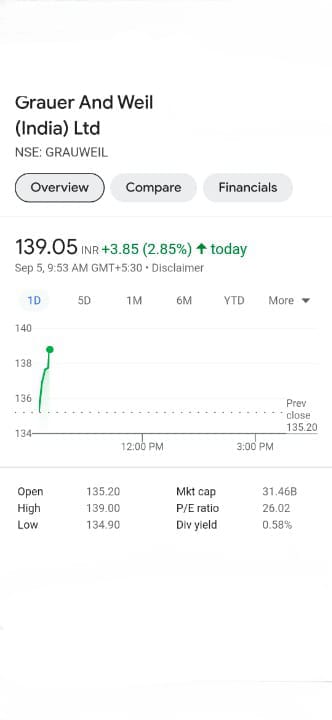

The number one company about which we are going to talk is in the business of surface finishing and engineering solutions. Along with this, the company also operates malls in Mumbai and the company has tried its hands in different sectors, including chemical engineering. It is expanding its business significantly in the sector like Paints, Coating etc. If we look at the market cap of the company then it is worth Rs 3116 crores. At present the share price is around Rs 137.

The company also provides dividend to its investment. The holding of the promoters in the company is around 69%, along with this, the debt of this company is around 24 crores, the company has assets of 625 crores and the liability is 222 crores.

This company is almost debt free company. Dividend payout of the company is also quite healthy. A company continuously provides dividend to its investors. After June 2020, the company's revenue can be seen to increase continuously. Institutional investors are more than one percent, in which FII is 1.21% and DII is 0.02%. Let us tell you that the name of this company is Grauer And Weil (India) Ltd. At present, the company is running overvalued and in the coming time it will increase. A fall in the stock of the company can also be seen.

If you find an opportunity after this decline, then you can make the right investment plan with the advice of your financial advisor and after properly examining the fundamentals and technicals of the company, make an investment plan so that you can enter at the right time. able to earn good profits by

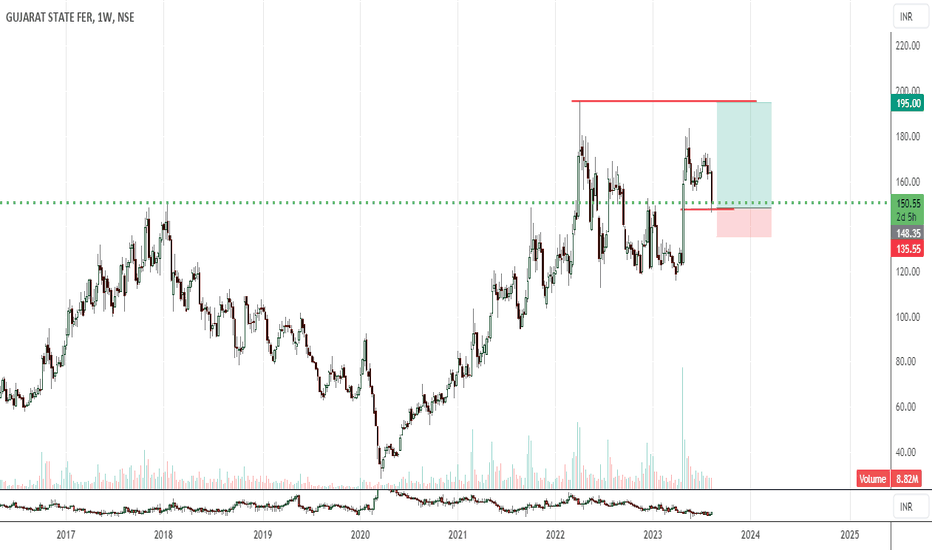

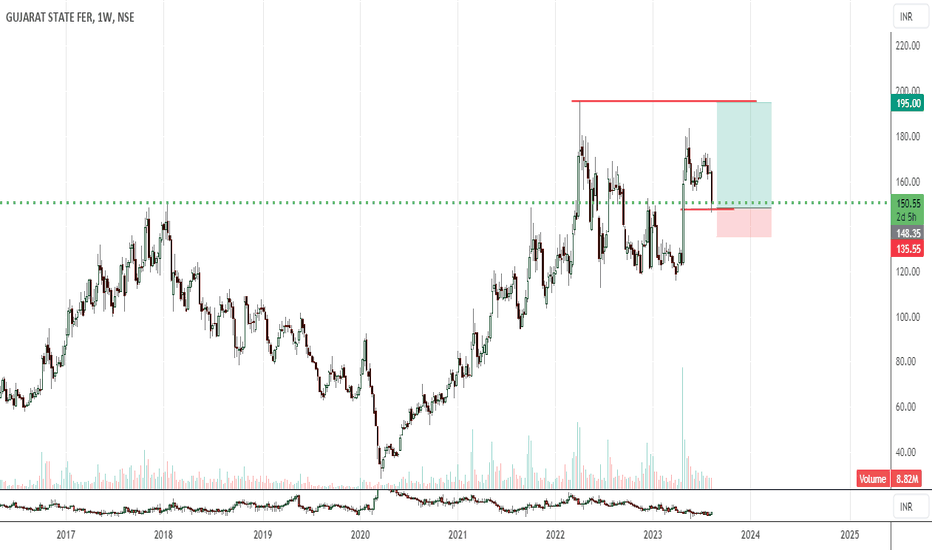

At the same time, we are going to talk about the second number company. This company has been doing business continuously since 1962. The company is related to the chemical sector. This company is run by the government. This company works in manufacturing various types of fertilizers and pesticides. Its partners are synthetic rubber and man-made rubber. If we look at the market cap of the company, it is more than Rs 7000 crore. Currently the share price is around Rs 178. The company continuously provides strong dividend to its investors.Which is around 5%, the return on equity is more than 10%, the company can

Company Assets is very good Liability is very less Results have been very good Company is adding on a good value even from the book value of the company Company keeps on paying dividend The holding of promoters is around 37% With this, this The holding of qualified institutional investors in the company is around 23%, along with this the government has also made its holding in this company which is around 5%.

According to the fundamentals of the company, the company is coming very strong, you can consider taking entry in this company, for that you should test the technical and fundamentals of the company properly, after that make the right plan to invest, which will give you strong profits in the long run. To see about the company the name of the company is Gujarat State Fertilizers & Chemicals Ltd

How did you like any information, please tell us by commenting in the comment section. If you have liked the information, then share it as much as possible so that our morale increases and we can bring new and fresh articles for all of you.

Disclaimer :- The vision of tvcfeed.com is to promote financial literacy in India. The content we post is purely for education and entertainment purposes. We are not SEBI Registered Financial Advisors. Therefore we do not provide any investment or financial advisory services. You will be completely responsible for your money and your decisions. Please consult a SEBI registered financial advisor for your financial investments.

Author:- Dr Vivek Garg

Table of Contents Introduction to Free Online Tools for PDF,...

Table of Contents How I Discovered Toolkhoj.com What Makes It...

महाशिवरात्रि के उपाय , बेर, काली मिर्च और धतूरे का...